Think about it, by saving your money in the bank, you are literally being charged for doing so. I mean you’re accruing debit for being a liquidity provider if you look at it from the lens of decentralized finance (DeFi). No one likes that kind of uninvited debits. Never the case with DeFi. But the returns from DeFi sometimes (if not most times) always look too good to be true. As of the time I was writing this piece, I am currently earning up to 150% annualized returns (APY) for supplying liquidity into a protocol. That's some juicy gains for me right there. Even stablecoin deposits can sometimes fetch liquidity providers (LPs) equivalent to depositors in traditional finance (TradFi) up to 10% APY if I’m being conservative.

The idea that a person can once again become sovereign and have absolute control over their money, which is usually the government’s exclusive right to mint and circulate through banks, is what birthed crypto. Innovations happening in the DeFi space are hinged on the premise that services offered in TradFi, like lending and borrowing, insurance, stock exchange etc., can be equally replicated by codes that run entirely on the blockchain. These codes are smart contracts that cut off intermediaries allowing for the permissionless exchange of value. That said, numbers as high as 1000% or even 17,4000 APY as we saw in some Olympus forks floated as viable returns on investment attracts usual criticisms from the gatekeepers of TradFi brandishing the DeFi sector as nothing other than Ponzi. If I’m factual, many decentralized protocols offering insane yields are nothing but pyramid schemes waiting to crash like a pack of cards the moment new entrants stop trooping in. But then, the DeFi sector due to its composability has had some networks like Ethereum, Solana etc., produce monster protocols like Uniswap, dYdX, Aave, etc. And if we must look away from some of the ridiculously high yields attracting degens and newbies like sugar ants to a honey dropping, Ethereum settled over $11.6 trillion in 2021 alone, beating that of Visa $10.4 Trillion. Who says DeFi is only where degenerate gamblers play?

Now, let’s get to it, from where does the yield in DeFi come if it’s not just Ponzi?

So, from where does the APYs come?

To understand the source of high yields in DeFi, it is important to understand the mechanics of money and people in terms of supply and demand. Generally, yield generation largely comes from filling the gaps in the market to satisfy human needs. These gaps include the demand for borrowing and leverage, exchanging and balancing risk appetite, service fees and stake appreciation. Financial services exist to fill these gaps. However, with DeFi, these needs are met with little to no marginal cost, making it possible to reward users the most. The decentralized nature of this innovative technology allows for a significant reduction in transaction costs by abstracting away central third parties facilitating peer-to-peer transactions, thereby improving transaction speed.

Generating yield in DeFi

Satisfying the demand for borrowing and leverage: Debt is a natural phenomenon in human society. The global economy thrives on it, so there's a natural demand for borrowing. In the corporate system, businesses borrow assets to purchase capital goods, the banking system runs on various forms of loans, and individuals borrow to meet various needs. Also, the high demand for leverage by investors looking to maximise their gains contributes to the high demand for borrowing as investors who expect an uptick in the future price of any digital asset may want to borrow to add to their bags. For example, one can keep a stablecoin like USDT in a DeFi lending and borrowing protocol and earn a high annual percentage yield (APY) in comparison to just holding the equivalent USD in a local bank.

Therefore, this fundamental need to borrow creates a market where people generate yield by lending out their funds to meet borrowers' needs. This is done more efficiently in DeFi with lending protocols like Compound, dYdX, Aave etc.

A user holding ETH may supply it to Compound or Aave protocol, borrow a stablecoin like DAI against it, then proceed to Yearn.Finance protocol to deposit the DAI and get yield-bearing tokens yDAI. This can then be deposited in the Curve protocol to earn more yields in Curve's CRV tokens. At every stage, the user earns APY returns. Of course, this is an oversimplified example but it is what typical yield farming looks like. In a nutshell, yield farming is any effort to put crypto-assets to work and generate the most returns possible on those assets. Farming in DeFi opens up various arbitrage opportunities, allowing LPs to take advantage of variations in asset prices across different protocols, and because LP positions are tokenized, they can be used across multiple platforms in DeFi. Yield farmers are very creative in seeking the best ways to maximise gains on their investments by leveraging various DeFi yield-generating protocols. Moreso, platforms like instrumental finance are working to alleviate the difficulties faced by LPs in chasing yield across different protocols by bringing together all established ecosystems into one single interface.

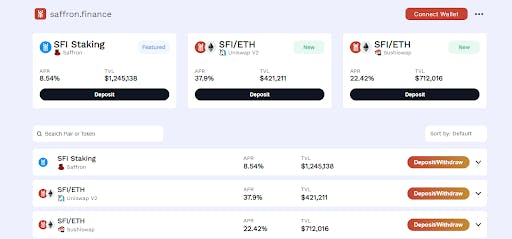

Exchanging and balancing risk: In financial markets, some investors are inclined to take more risk than others while participating in protocol offerings. Hence, the need to balance this difference in risk tolerance creates a market for risk exchanging risk. For example, risks are exchanged in financial markets through options contracts. Investors with a lower tolerance for risk pay a premium to protect themselves against large market fluctuations by buying options. On the other hand, more risk-tolerant investors increase their exposure to market risk by selling options and thus earning some yields. These risk-exchange contracts are popular in traditional finance. However, in DeFi, protocols like Saffron Finance leverage blockchain technology to provide more efficient risk-exchange services.

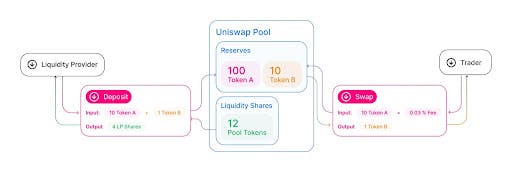

Service fees: One of the popular ways to generate yield in DeFi is by liquidity provisioning (LPing). Asset liquidity is essential for every DeFi activity. This is because DeFi protocols need to make a wide range of assets constantly available for users to carry out various financial transactions at any given time. Without liquidity, the operational capacity of a protocol will be limited, and this results in market inefficiency. Therefore, to ensure constant liquidity, DeFi protocols employ a combination of different yield-generating strategies that benefit both the protocol and the LPs with their LP positions. These strategies include;

Staking - earning yield by contributing to protocol's security.

Bonding - purchasing liquidity at a discount.

Liquidity mining - earning yield on protocol's native token.

Flash loans - exploiting arbitrage opportunities on asset price slippages.

Shorting - borrow to sell at a higher price and then buy back at a lower price to repay, and many others.

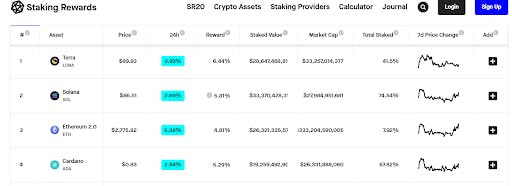

Stake appreciation: Another source of yield generation in DeFi is by owning a stake in a protocol or a network. By purchasing and holding a crypto asset, investors take a bet on the future appreciation in the particular asset’s value. This is done through staking. And because DeFi assets are currently in the hyper-growth phase, most of the high yield APYs in DeFi are due to this value appreciation. Staking is one of the most popular ways of generating high yield passive income in DeFi. For instance, Frontier enables users to stake and earn APYs up to 11% on tokens such as ZIl, BLZ, Band, Kava etc.

Despite the new and innovative yield options constantly getting introduced into DeFi, not all will be sustainable. However, the current DeFi landscape has seen more innovations and improvements on existing yield strategies. Some strategies are low risks such as staking and liquidity mining, while some are medium to high risks, such as shorting or flash loans depending on the APR or leverage LPs are after. Understanding the mechanism, risks and potentials each of the strategies hold and how the yield is gained and distributed, liquidity providers can gauge their risk appetite and make choices.