An L1’s Achilles heel: Security implications of NEAR Protocol’s USN stablecoin move

With the apparent success of the LUNA-UST experiment and the notorious copypasta crypto culture, I just knew that it wouldn't be long before more projects jumped on the bandwagon. Terra transformed itself from a regular application-specific blockchain to a bastion of dApps like Anchor and others in the Cosmos ecosystem. Terra’s flagship, however, is UST, an algorithmic stablecoin linked to the network's native governance token, LUNA. UST maintains its peg to the dollar through a burn-mint mechanism, i.e. mint UST, burn LUNA. But here’s the real gist, NEAR, a decentralised smart-contract enabled blockchain that Vitalik once said could truly rival Ethereum, is towing the Terra - UST move. NEAR has announced plans of creating a native stablecoin, USN. If that were only the case, it would mean no gist here. Right? There’s more.

With Terra still enjoying the spotlight, I say still because every chain has its hype moment, NEAR is out with a ploy to steal the show by offering the same 20% APY rate to rival Anchor's attractive stablecoin yield. I think this is a wrong move for NEAR, not just because it is trying just to copypasta Terra’s move, but launching a stablecoin that acts as the settlement currency of a layer 1 (L1) on it exposes it to long-term security risks. I outline my argument below.

First, the basics, what is the NEAR protocol?

"Scalable, high transaction throughput. rapid YoY developer increase". These are some of the qualities of the NEAR protocol as described by Captain Zoran Kole in his article titled “The Future is NEAR,” equating NEAR’s “futuristic” success with Terra. But he failed to realise: that Terra is built with Cosmos SDK and taps into the Cosmos' Tendermint BFT engine consensus protocol for security. On the other hand, NEAR depends on itself for security, and the security implications are one where two competing tokens on its base layer should not be taken lightly. USN is still in the pipeline, but no one is certain if NEAR will adopt the LUNA-UST burn mechanism for the NEAR-USN project. Since we’re still all shrouded in uncertainty, it is also worth noting that despite the success of the LUNA-UST project, it is yet to be tested in an extremely bearish market condition. Do Kwon knows this and is already hedging with Terra's 4Pool launch on Curve and the aggressive Bitcoin Reserve build up. Let’s get back to NEAR.

NEAR Protocol is a highly scalable development blockchain platform built with a sharded, proof-of-stake (PoS) consensus mechanism. As a developer and end-user-focused platform, NEAR's value proposition is to drive adoption through simplicity. This means that the platform measures its success by how easy it is for developers to build products on the network and how easy it is for end-users to interact with these products. Perhaps this is why NEAR is often portrayed as the "already implemented Ethereum 2.0". Sharded, PoS chain, EVM compatible cheap, fast transactions while equally being environmental and developer-friendly. These are some of the sexiness of NEAR. It even has its native bridging solution, Rainbow bridge, and an EVM compatible layer 2 (L2), Aurora.

Nodes running the NEAR Protocol software ensure transactions are accurate and known to validators. And through the staking mechanism, validators receive a reward for maintaining the NEAR blockchain’s security and validity. With Nightshade, the network benefits from fewer potential points of failure when it comes to security, as participating nodes are only responsible for maintaining smaller sections of the chain. However, the biggest difference between NEAR and the soon-to-be-merged Ethereum PoS chain is that NEAR uses a single chain that shards each block instead of a beacon chain. This ensures data availability for consensus while mitigating shard level attacks.

Blockchains as a business

To fully understand the security implications of NEAR's recent stablecoin move, let's look at the mechanics of blockchain networks.

Apple sells iPhones. Facebook sells data. Blockchains sell blocks!

The whole idea of a blockchain is the value for blocks space, and L1 blockchains work by selling block space for their native token. The native token is issued to users providing security for the network through mining or staking. The more valuable the block space of any network, the more value the native currency of that blockchain attracts.

A 51% attack where a malicious attacker takes over a blockchain network and starts to reorg blocks is an inherent threat every L1 blockchain faces. This is why blockchains adopt decentralised consensus mechanisms to protect against this malicious attack. Whether miners in the Proof of Work (PoW) model or validators in the Proof of Stake (PoS) model, the idea is to distribute consensus among many operators to limit the risk of compromising the network's security architecture. And a blockchain's native token is the unit of value by which the security framework of the blockchain is measured.

L2 Rollups depend on Ethereum for their security. In high-value networks such as Ethereum, it is expensive to carry out security attacks such as 51% attacks. The higher the amount of value locked on the network, the higher the minimum amount an attacker would need to acquire to carry out an attack of this sort. Hence, lower cap L1s with less economic security are more susceptible to 51% attacks. Therefore, it is critically essential for L1 blockchains to expend much more effort to grow the value of their native token so that it is sufficiently secure against well-funded attackers. For instance, self-sovereign L1 chains called parachains built on Layer Zero networks like Polkadot fend off this kind of security concern by plugging into the security architecture of the Polkadot’s Relay Chain.

In more specific terms, blockchain networks can increase the value of their native token through cryptoeconomically engineered means, including scarcity, utility and demand. Ethereum is a perfect example:

The introduction of the EIP-1559 burn mechanism burns some portion of the $ETH generated in transaction fees, permanently removing them from circulation. Since implementing the EIP-1559, over 2 million $ETH have been burned, further reducing circulating supply and driving scarcity, both of which are the recipe for a long term upward price movement. Moreso, since the activation of the Beacon Chain in 2020, over 11 million ETH has been staked, further dwindling the circulating supply.

Ethereum currently has over 300,000 validators and averages about $300 in gas fees, a plus for validators being issued $ETH any day regardless of the stress to end-users. Ethereum is still the go-to chain for most DeFi activities. The Ethereum based NFT marketplace, OpenSea, records at least $200 million in daily trading volume. All these give value to the network's native token because gas fees are paid in one currency only — $ETH.

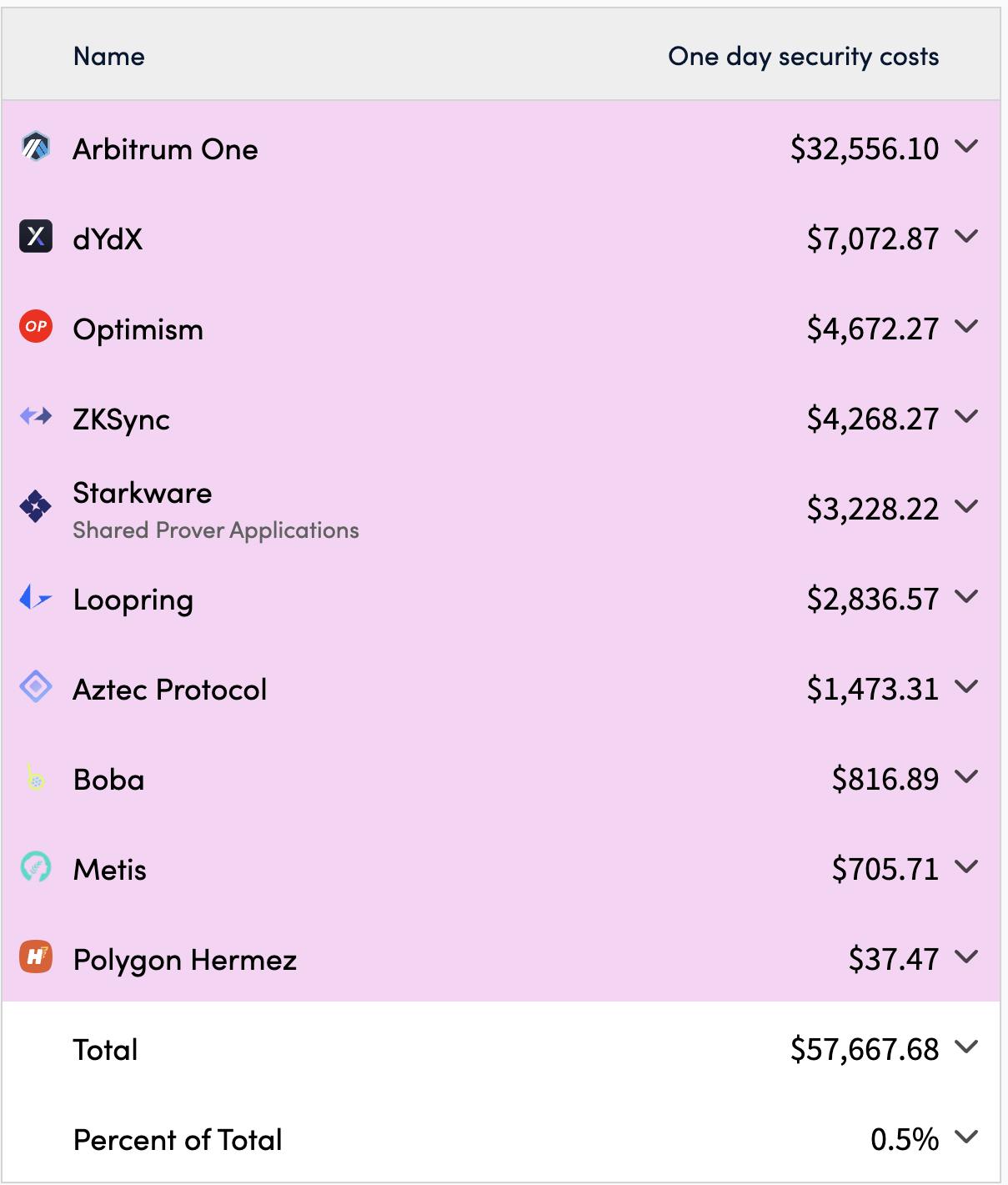

Without valuable block space, a chain is basically open to attacks on all its flanks. Therefore the token of an L1 blockchain must continue to grow and attract value for the network to remain safe, as the value of a blockchain network determines how secure it is. Tracking site Cryptofees reveals each blockchains network's daily revenue volume in terms of fees. The leading network, Ethereum, currently rakes in over $15 million in daily revenue. This revenue is also generated through L2 rollups and sidechains that pay for the security offered by the base layer in the network's native token. A reflection of how valuable Ethereum's block space is to users is a healthy metric used to determine the long term sustainability of a network. I get the sentiment of people that say the Bitcoin network is the most secured and decentralised. A fair point, but consider using a simple scripting system for recording transactions on its blockchain. Ethereum, on the other hand, is Turing-complete and can face DDoS security threats in the case of infinite loops, hence the gas fees before you can carry out any smart contract action on it.

Security implications of USN stablecoin to NEAR Protocol

Ideally, L1 blockchains should only act as a settlement or data availability layer for rollups to scale throughput without compromising security. These transactions are facilitated using the blockchain’s native token, not its stablecoin. But the token design of the $USN stablecoin is heavily intertwined with the protocol, making it a direct competitor of the network's native token $NEAR. With several incentives directed towards the $USN stablecoin, such as the 20% APY, projects on the NEAR ecosystem such as NFTs, dApps and liquidity pools and other DeFi activities will rely more on $USN and less on $NEAR, making the stablecoin more valuable than the network's native token. The implication is that the overall usage of $NEAR will dwindle, weakening its value and hence the security of the whole network.

Here is a picture of what this will look like;

The price of $NEAR at the time of writing is $16.02 giving the network an overall market capitalisation of $10.78 billion. This value comes from using the $NEAR token to facilitate transactions on the network's native protocols like the Nightshade sharding solution, Rainbow bridge and the Aurora L2 scaling solution, etc., and paying for storage fees on the network. Hence, the more value attached to a network's native token through its utility, demand and scarcity, the more expensive it is for a malicious attacker to carry out a security attack. With the introduction of a new token, the stablecoin $USN will have to compete for value. The fact that it is even an algorithmic stablecoin makes it even more difficult to maintain the dollar peg. And a stablecoin without deep liquidity and usage can’t also be stable. And without a precise balance between the two tokens on the base layer, a shift in incentives towards the $USN can lead to a corresponding decrease in the value of the $NEAR token, making it cheap enough for a malicious attacker to carry a 51% attack on the whole network.

Without a robust native token, a network is ripe for malicious attacks.

It’s still NEAR to rethink the USN move

Until the $USN stablecoin is deployed and goes live, I can only speculate based on the existing nature and dynamics of the NEAR protocol. Current realities indicate that having a second settlement currency on the NEAR blockchain network can only put the security integrity of the network at risk. Supercharging the adoption of the NEAR protocol by implementing an economic strategy centred around a native stablecoin like Terra's UST could work out well with good cryptoeconomics and token design. That would entail a balanced token incentive structure that doesn’t in any way breed a compromising overlap with the already existing native currency. Also, NEAR could thread the traditional stablecoin route of bootstrapping liquidity on Curve.fi or, rather, diversify the utility of both tokens by adopting a modular architecture on the base layer.

While the LUNA-UST project may likely be the motivation for NEAR's USN, Terra’s recent growth has not passed through a vicious bearish cycle to see how foolproof it is. Following Do Kwon's playbook might be a risky play for NEAR protocol. Can $USN compete with $UST? With this new playbook for other ecosystems to follow, we will see more L1s creating their stablecoins.