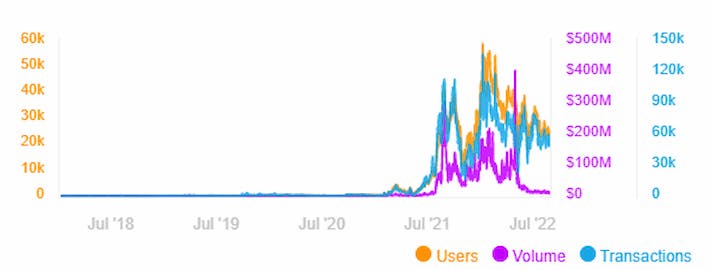

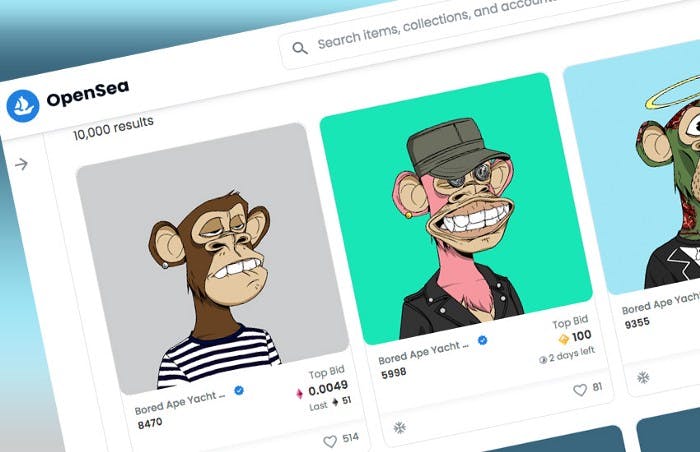

It’s the winter season again in the crypto market. And like every other thing in crypto, the street is painted red with collections bleeding their noses as NFT sales tank by 99% in 90 days. Data from the analytics site, DappRadar reveals that the daily NFT trading volume on OpenSea, the most popular NFT marketplace, declined from its record high of $405.75 million on May 1 to only $5 million on August 28. Nothing short of an NFT nuclear fallout! And like any nuclear apocalypse, even the hottest blue-chip NFTs couldn’t escape it. Bored Apes NFT has seen a more than 15% drop in trading volume in the past month. Its floor price also fell from a high of 153 ETH in May to 72.5 ETH in August, sparking massive liquidations in BendDAO. There is also been a significant drop in the search volume of NFT-related terms in the last 3 months.

Okay, the gloom isn’t going away anytime soon, based on the macroeconomic outlook at least. Should innovators then abandon ship and move on? I think not! And if you're part of any team building in the space, or VC and PE firms funding some of the A-rating collections out there, you must understand that beyond product, the power of narratives and community in the NFT space towers above just a ‘sweet’ product. The mimetic value of NFTs is highly community-driven. Hence, regardless of how good the product is, without a strong community who believes in the fundamental idea of the project, then it is difficult to find a reason to hold the asset, especially in down markets.

The undying debate on the most important key factor in building a successful NFT project will remain. Wading into the scene, I have even published a few pieces on how to market an NFT project successfully. Some argue that a good product offering is what ultimately determines success. Their premise is that if you create what the market wants, it rewards you with a premium. While there are some elements of a truism to this, one question that begs for answers is how exactly do you know what the market wants? This is the problem with approaching an NFT project with a product-centric mindset. Some collections started with great products, selling out in minutes on launch, instant hits but only to face slow, drawn-out death in the long term. Ultimately, it comes boils down to having an army of the community that believes in your project and its team and are willing to fiercely propagate its message. In this piece, I explore the significance of a strong community to the success of any NFT collection. I expatiate on the hot burner issues NFT communities need clarity on which any collection must address head-on comprising rewards systems, ownership rights and a plausible roadmap as vital tools that can be leveraged to sustain the long-term viability of any NFT project.

What qualifies as a successful NFT project?

Bored Apes, CryptoPunks, Cool Cats, Doodles, Azuki, and Goblintown NFTs. These projects come to mind when talking about success in the NFT ecosystem. What did they do differently?

If you are familiar with any of these collections, you'd recognise that they are entirely different from one another. You could argue that they all have unique artwork. True. But is that a good enough success determinant? Their artworks fall on different scales in the aesthetic spectrum. Azuki and Bored Apes, for example, are well crafted and have outstanding designs. I know some call it ugly, but I think in terms of aesthetics, they check off; anyone can argue otherwise.

On the other hand, projects like the Goblintown NFTs and Mfer NFTs are simple, hand-drawn, and not exactly aesthetically pleasing. Yet, these projects are all in high demand regardless. The nature of products at the core of most NFT projects is not particularly innovative. Innovation takes many forms, I know. But at its core, it is the process of iteratively improving on something that originally existed. The emphasis is not anything entirely new. Creating a thousand varieties of apes or pixelated avatars with varying degrees of mutation, mirroring or animation may not exactly be considered innovation. However, accessing the value of NFT projects from this perspective misses the most crucial aspect of what NFTs stand for, community!

So again, NFT collections are not just about the quality of the art but the social renaissance they propagate. Without a network of people howling at the charge of a project, success is just a pipe dream. Are people determined to collaborate, promote and build their identity around your collection? It boils down to the fact that every successful NFT project is, at its core, a community-driven endeavour. It usually starts as an idea from a minute group of individuals or a development team. This idea serves as the foundation of the community. As the idea matures, it attracts like-minded individuals who resonate with the project's vision.

Community as the cornerstone to NFT collections' success

Most NFT projects start with a product, an artwork relying on scarcity and novelty. However, without even basic utility, the result is often the same—failure! This is because, without a viable utility, there's nothing to build a community on. And without a strong community, the project is starved of adoption and ultimately dies.

The power of community becomes apparent when you compare Cryptopunks and Bored Ape Yacht Club (BAYC) projects. These two blue-chip projects have different histories. The OG CryptoPunks NFT is unarguably the project that opened the world’s eyes to the potential of an NFT project. The project possesses immense socio-cultural significance in the crypto ecosystem. But despite its significance and a definite first movers advantage, it is no longer the most exclusive NFT project today. The BAYC, a project that is light years younger than CryptoPunks, now holds the title.

How did BAYC do it? They introduced utility into their NFT collection. This utility added extra features that the community could rally around and provided commercial rights to those that owned the asset. The project became community-driven, benefits were decentralised in their distribution and holders were empowered to use their assets however they see fit, which benefits the community at scale. The idea was that anything the community did with their NFTs helped grow the brand. And this approach paid off.

Some key factors that play a major role in NFT collections leveraging the power of community

IP and ownership rights

Intellectual property and copyrights are crucial parts of a project’s community structure. There is an ongoing debate around the extent of the ownership rights of holders when it comes to NFTs. For instance, earlier, CryptoPunks only allowed collectors to use its NFTs as profile pictures. Anything more violated the creator's IP rights. Bored Apes, however, permitted holders to monetise their Ape characters, so long as they didn’t try to monetise the BAYC logo itself. This led to some interesting dynamics, for example, the Bored Wine Co., a business where you could send your Ape in to be transformed into a unique label on a vintage wine.

Some projects circumvent the complexities associated with ownership rights by adopting the CC0 copyright licence. The no rights reserved Creative Commons (CC0) licence allows creators to waive legal interest in their work and move into the public domain, effectively decentralising ownership rights. Goblintown and the Nouns NFT have attained unprecedented success due to flexibility in ownership structure. As valuable as this may be, CC0 licensing is unsuitable for all projects.

Retroactive CC0 licensing is almost always a bad idea. Many projects have made the mistake of pivoting their original ownership structure a bit to attract the success of CC0 projects. A notable example of this is Kevin Rose and his team switching up the licensing structure of the Moonbirds and Oddities NFTs to CC0. This caused quite the stir in the community, with many people not being happy with losing exclusive rights to the NFTs. Some community members were heartbroken about not being consulted in the decision-making as holders of such NFTs in the first place.

There have been many discussions about when to adopt CC0 and when to stick to defined ownership rights. It all comes down to what the project wishes to achieve long term. This is important because the type of licensing right a community adopts helps communicate its vision and goals more clearly. However, if there's a need to change the licensing structure of a project midway, for instance, a retroactive CC0, then that decision must be largely galvanised by the entire community.

The decision by Kevin Rose to switch to CC0 months after Moonbirds launch may not have had any damaging repercussions for the project. But this can be attributed to the strength of the parent brand, PROOF, in the industry, as well as the proactive initiatives of Rose and his teams, such as the $50 million project funding and a series of other events in the pipeline. This was obviously enough to quell the anger of distraught token holders. Not many collections can social “PROOF” their decisions this way without it backfiring.

Royalty distributions

One unique value proposition of NFTs is the ability for creators to earn royalties from secondary sales of their NFTs in perpetuity. Recently, Sudoswap launched SudoAMM, a feature that lets people trade their NFTs without paying royalty fees. The surging popularity of this feature has sparked major discussions within the NFT ecosystem, as some argue from an ethical perspective. In contrast, others believe that traders shouldn't be subjected to a mandatory tax as a way to keep rewarding creators in perpetuity. Well, maybe the answer is somewhere in between. Of course, creators deserve to be rewarded for their efforts. But just maybe earning juicy royalties from secondary sales in perpetuity is a bit too much.

However, creativity such as that brought by genius artists like Beeple should also not have to suffer because traders avoid royalties. Some arguments are of the notion that royalty payments should be hard coded into NFT smart contracts. But this is technically impractical, at least with our current technology. This is because enforcing royalty payments at the smart contract level means incurring royalty fees every time an NFT moves from one wallet to another. There's just no way smart contracts can tell the difference between transferring an NFT to a friend as a gift and transferring to a potential buyer. The smart contract will essentially treat both transactions as the same, making royalty enforcement impractical. Like tipping in traditional establishments, royalty payments are an essential moral obligation, an ethical responsibility accepted by most NFT marketplaces to reward creators for their effort. However, in a free market, buyers should be given the option to choose. Some collectors have expressed their willingness to support 1/1 NFT creators by honouring royalties but consider royalty payments for 10K PFPs borderline exploitative.

There needs to be some sort of middle ground here. For example, a solution can come in the form of adopting a tiered royalty model up to a specific number of secondary sales or maybe just like tipping, and buyers can be allowed to choose to pay royalties or not. Also, it is crucial to have new technologies that allow for flexibility in royalty distributions among communities. Brands and creators can tap into this to strengthen their communities. Quantix is an NFT marketplace that enables shared ownership as well as royalty distributions. In terms of royalties, unlike Sudoswap, Quantix supports royalties for NFTs. When a seller initiates a 100% sale via the Quantization Phase, the royalties are calculated on the selling price set by the seller and paid out after the end of the Quantization Phase (QP) for community Quantization. In the case of partial sale - where the seller keeps portions of the NFT, the royalty payments will be done in two parts. The first of which the sales of the fractions sold in the QP will be paid out after the QP ends, and the second part (portions reserved) will be paid out to creators when the NFT is sold. Aside from community Quantization, Quantix also has self Quantization where royalties are paid out to recipients after the final buyout and calculated on the selling price.

Liquidity and tradeability

The inherent lack of liquidity of NFTs has always been a major pain point for NFT holders. As NFT brands, games and Metaverse projects develop rapidly and publish ambitious roads, the current NFT technology infrastructure grows more clunky and rigid, leading to bottlenecks. This creates issues in critical areas such as the difficulty of accessing liquidity for blue-chip NFT holders; problems with maintaining community growth without raising barriers to participation; scaling issues with gaming guilds as they continue to grow their scholar base, as well as incubating new DAOs; limitations to yield generation on NFT assets owned by Metaverses landowners and developers etc.

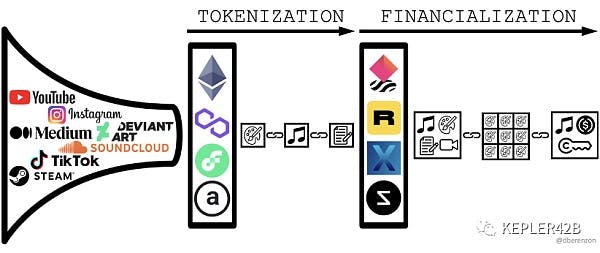

Liquidity is a major factor in keeping a community together. While a community may be willing and ready to defend and drive a strong narrative around a project like fanatics, they are also not beholden to a project. It is ultimately about the alignment of interest in the end. And in line with the core tenets of decentralisation, they decide who they align with. Therefore, liquidity is quite important for any project in keeping existing holders and attracting newer ones. Improving the liquidity of NFTs is a great way to foster community growth and engagement. There are the tenets on which NFT financialisation rests.

By creating an environment that makes it easy for holders to trade or monetise their NFTs, businesses and creators can unlock the true potential of their communities. This is why projects like NFTfi, NFTX, reNFT, Genie and even Uniswap are all plugging holes in various aspects of NFT financialization such as lending, financialization, pricing, rental and aggregators. Also, Quantix is another pivotal platform for improving NFT liquidity and tradeability. As an NFT marketplace, Quantix helps creators/collections further grow their communities without having to dilute the supply or create a new or parallel collection by providing them with the necessary tools to fractionalise rare premium NFTs and facilitate tradeability in a highly liquid and efficient market. With Quantix, collectors or traders with smaller ticket sizes can access NFTs they initially couldn't afford through a process called Quantization or purchase a whole NFT at a fairer market price. This promotes inclusion and diversification in NFTs.

Scaling the financial layer of NFTs is key for collections to build thriving communities effectively.

NFTs are built for communities. They bring communities together and enable them to thrive. In the NFT ecosystem, communities come in different forms and sizes. This determines their levels of success. Some are more exclusive than others, some are large and vocal, and others are small and quiet. NFTs maximise the community-building potential of businesses or organisations. And successful projects are determined by the quality of their communities. However, building a community around NFTs is not always easy. And the most exclusive NFT communities count A-list celebrities, ultra-wealthy fans and heavyweight crypto natives among their ranks. The average individual is usually priced out of these communities.

Understandably, the NFT sector is still evolving with myriads of untapped opportunities that may herald new products and features to help unlock greater value add in the sector. However, for this to happen, there is a need for composability among existing and novel collections to fully unlock their potential as an asset class. CC0 is one such catalyst that allows innovators and end users to remix, spawn use cases and commercialize NFTs as far as their imaginations can go without restrictions. And as this happens, we will see more composability. Fractionalisation platforms exist to lower the entry barrier in the NFT sector especially because of the exclusiveness of premium NFTs. The ability for fractionalisation platforms to compose into the broader NFT ecosystem like index protocols to read from pricing oracles, and lending protocols leveraging the liquidity of NFT derivative markets is pivotal to unlocking the full potential of NFTs as a technology. NFT rental marketplaces, which can be described as the “Airbnb of the metaverse", also show big potential.

Looking to scale the marketing of your NFT project? Reach out to me on LinkedIn or Twitter 🫡